🚗 Article Key Points + Summary

- 20/4/10 Guideline: A popular guideline suggesting a 20% downpayment, a maximum 4-year financing period, and monthly expenses below 10% of your income for a car purchase.

- 1/10th Guideline: Advocates buying a car in cash, with its cost not exceeding 1/10th of your annual pay, suitable for a frugal approach.

- Dave Ramsey's Guideline: Ramsey recommends that all your cars should not exceed half of your annual income and is ideal for cash purchases.

- Consider Age, Savings, and Debts: These guidelines often overlook age, savings, and existing debts, which can significantly impact your car-buying decisions.

- Personal and Individual: These guidelines are exactly that - guidelines, but it's essential to remember that the right car purchase decision is highly personal and should consider your unique financial situation and goals.

Buying a car will be one of the biggest financial purchases of your life. Because of the important nature of this decision, guidelines have been made for determining how much car you can afford based on your income, monthly expenses, and current debt. However, other factors like other major purchases in the near future and opportunity cost should also be factored into your decision to give you a more holistic decision.

So, you're in the market for a new car, or perhaps you've already made a purchase and are wondering if it was a sound financial decision. While you can't change the past, you can certainly learn from your mistakes to make better choices in the future. In this article, we'll explore some of the most widely recognized car financing guidelines, illustrate them with real-income examples, and discuss the common shortcomings in these guidelines, among other things. Let's dive into the world of car buying!

20/4/10

The first guideline of car buying we'll look at is called the 20/4/10 guideline. This guideline seems to be the most popular guideline among financial experts. This guideline says you can afford a car if you meet the following 3 requirements:

- You can put 20% of the purchase price as a downpayment.

- You finance the car for no more than 4 years.

- Your monthly expenses for the vehicle - including loan payment, insurance, gas, maintenance, registration, and annual emissions check) are less than 10% of your gross monthly income.

It's essential to note that determining the exact car you can afford based solely on your income is a complex task due to variables like your down payment and interest rate. However, let's walk through a couple examples.

If you bring home $50,000 a year, according to this guideline, if you put down $5,000 at an 8.5% interest rate with good credit (a score between 700-779), with average monthly insurance at $150, and average maintenance at $100 - you can afford a car worth just over $11,000. In this scenario, your monthly payment would be $416 dollars ($166 for loan payment, the rest taxes and insurance) - exactly 10% of your gross monthly income. For individuals with an annual income of $100,000 and the same down payment, interest rate, credit score, insurance, and maintenance costs, the affordable car value increases to just under $27,000.

As you can see, these are not high numbers at all. Given the fact that the median income is a little over $74,000, and the median price of all new and used cars is $47,000 and $28,000 respectfully, we can clearly see that Americans are overpaying for cars.

1/10th Guideline

The next 2 guidelines encourage you to not take on any debt. Starting with the 1/10th guideline, created and pushed by Financial Samurai, this guideline states: buy a car in cash that costs less than 1/10th your gross annual pay. If you make $50,000 you should buy a car in cash worth $5000. If you make $100,000, the car you buy should be worth no more than $10,000.

Out of all the guidelines to go by when buying a car, this one allows you to buy very little car. While the 1/10th guideline might lead you to choose a car that seems less extravagant compared to the ones you commonly see on the road, it also empowers you to prioritize your financial well-being.

Dave Ramsey's Guideline

The final guideline is by Dave Ramsey, the well-known host of the Ramsey show. Dave says that the total of all your cars should not be worth no more than half your annual income. To make this simple, let's say you only want to own 1 car. This would mean if you make $50,000 you can afford a car worth $25,000. Furthermore, if you make $100,000, you can safely get into a car worth $50,000.

Oh, and if you're wondering about financing, there will be none of that here. Dave recommends staying out of debt at all cost, so you'll have to fork up cash for that car. Most people do not have this kind of cash laying around and even if they do, there are probably better uses for it so I would still recommend financing in that case for most people. More on that in another post.

What These Guidelines Get Wrong

While these guidelines are very good to start with if you're in the market for a car, I believe they leave out some crucial information.

Age

The first thing these formulas get wrong is not taking into account your age. Because all 3 of these formulas base on salary, if a 25 year old and a 65 year old are making the same salary, according to any of these guidelines they would be suggested to purchase a car of the same value. Even though the 25 year might be in $50,000 of student loan debt and the 65 year old may have 3 million dollars in a 401k account and combined social security benefits and pension of $5000 per month. This does not make any sense.

Your Bank Balance

Just like with age, the money in your bank accounts is different. Someone who has been saving up for a few years to get the nicer car should certainly be able to get it. Likewise, someone with a high income but low savings maybe should opt for the less expensive car. After all, having a high income does not mean you are good with money and should drive an expensive car. 51% of Americans making over $100k a year live paycheck to paycheck!

Other Debt

The final factor these formulas don't take into account is how much other debt you have. Obviously if you have lots of other debt like a mortgage, student loans, or another car payment, you should adjust your price accordingly. If all your debt and bills allow you to save nothing for retirement, that is not a good situation to be in.

Future Goals

Let's say you check off all the boxes for any (or all) of these guidelines. This means you have the cash for 100% of the car, no other debt, and it's only 30% of your income. Sounds great right! Well, what if you want to get married and buy a house in the next year. I would certainly say that those goals are more important than getting a nicer car. It's always important to keep these things in mind while car shopping.

Reasons to Never Buy an Expensive Car

If you've run the numbers and you are able to purchase a nice car, should you? That is only a question only you can answer. Some people say you should never buy a nice car because cars are depreciating assets. Others say once you are financially secure, go for it. As I mentioned in the last paragraph, also take into consideration future goals. Your kids college, a house, a wedding, or a vacation could all take priority over a nicer car.

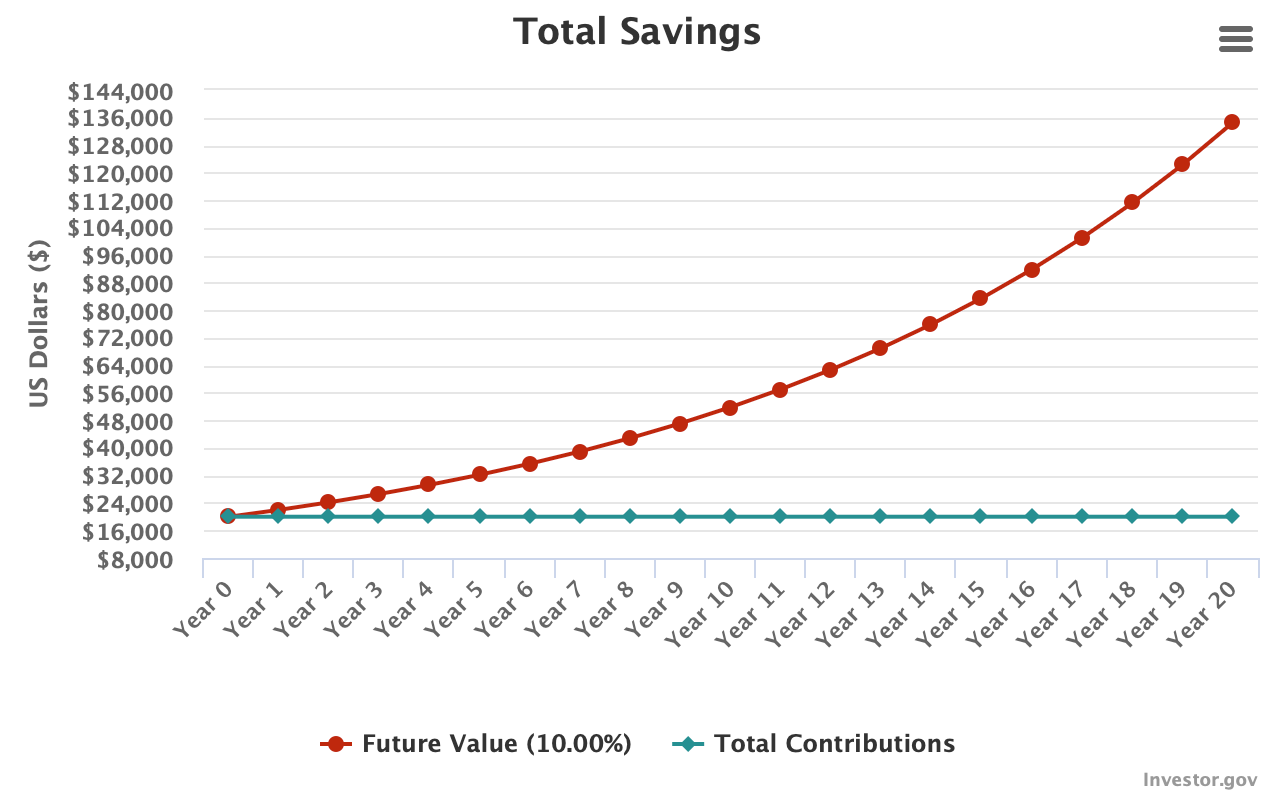

Additionally, consider the opportunity cost. Even if you can afford a $40,000 car, should you? $40,000 is a lot of money and you can do a lot with it. Instead of buying a depreciating asset that will almost certainly lose you money (and a lot of it), consider buying below your means and investing the rest. If you were to by a car worth $20,000 and invest the remaining $20,000 at a 10% annual return for 20 years you could end up with almost 7x your initial $20,000!

Final Note

At the end of the day, how much you spend on a car is a personal decision and cannot be determined solely by some guidelines. However, to give my take, I recommend buying a car in cash - unless you can get a super low interest rate. The value of this car should not be based on your income but by how much cash you have and what your next 5 - 10 years look like. Having no car payment gives incredible peace of mind and opens up many other opportunities. Best of luck with your car buying journey!