Many people who try to pick stocks fall short. It's common for these institutional and retail investors to trail the market by multiple percentage points year over year. We call this style of investing active management. You might think index investors (passive management) would be able to obtain returns equal to the index, right? According to Morningstar, passive investors also have a hard time matching index performances. Why is this and what can we do about it?

Defining the Problem

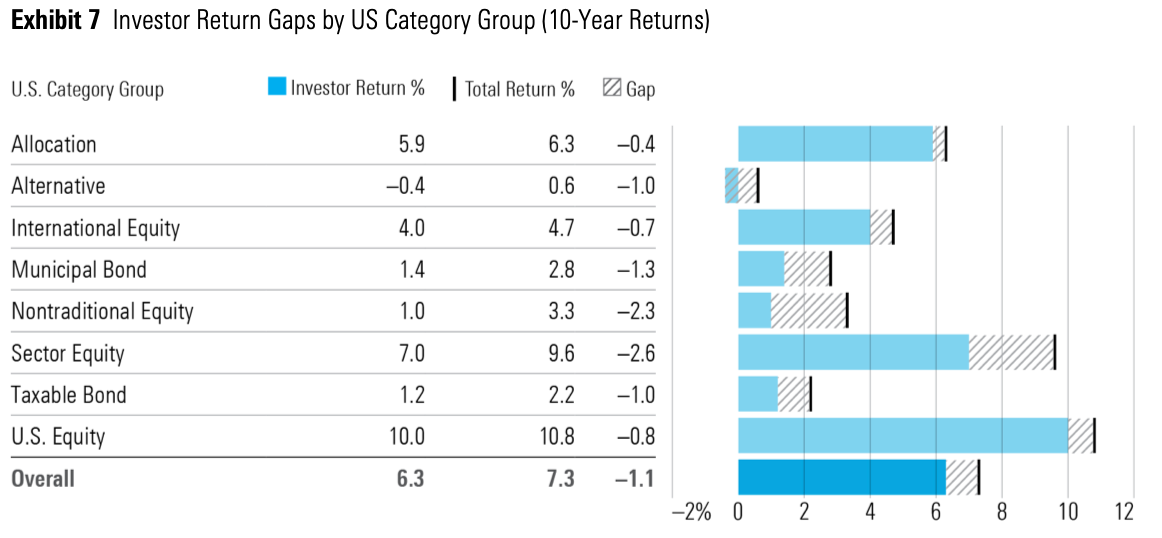

An annual report by Morningstar titled "Mind the Gap 2024" looks at investor returns compared to fund returns. In the report they find that that there was an average gap of 1.1% from the total return of the fund versus the return of the investors in that fund over a 10 year period ending Dec 31 2023. Morningstar looked at over 20,000 fund share classes spanning a number of different asset classes, fund types, and management styles. Below are a few.

US Equity fund

- Investor return: 10%

- Fund total return: 10.8%

- Gap: -0.8%

International Equity

- Investor return: 4%

- Fund total return: 4.7%

- Gap: -0.7%

Municipal Bond Fund

- Investor return: 1.4%

- Fund total return: 2.8%

- Gap: -1.3%

Here are the rest of the returns summed up in one chart:

Here is a quote from the article about passive fund performance as well as an insight as to why these gaps may be occurring (we'll dive deeper into some of these reasons below)

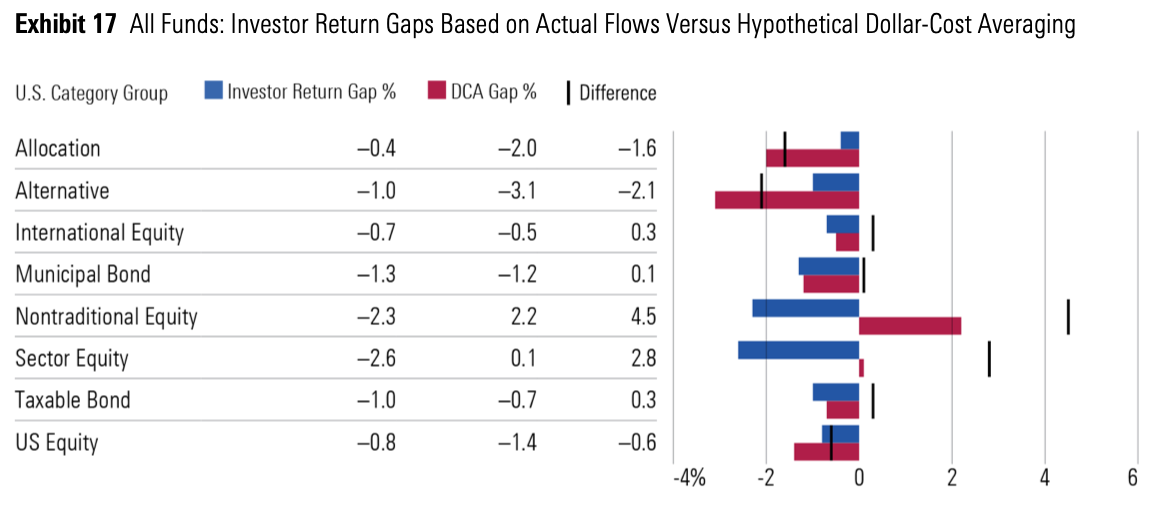

Dollar-Cost Averaging

At this point you might be questioning if investors are trailing the funds because investors dollar-cost average and the funds do not. Dollar cost averaging for retail investors is inevitable. We invest each paycheck or whenever we have extra money. It is not possible for us to simply make a lump sum investment at the beginning of every year if the money has not been earned yet. This means the return for the fund would be a time-weighted return while the investors return would be a dollar-weighted return. Given that markets generally go up, this might explain the shortfall. Morningstar looked at this too.

Dollar-weighted return: Factors in additional purchases and/or withdrawals

Morningstar looked into this as well. Here is a chart comparing the investor return gap we saw earlier to a hypothetical dollar-cost average gap:

As we can see from the graph, dollar cost averaging actually improved the gap in 5 of the 8 groups they studied. This is not what we would expect in theory. There are 2 reasons Morningstar attributes from this:

- Sector equity funds had strong performances with the bulk of the returns in the back half of the decade. Because of this, having more money invested at the beginning would not have helped much.

- When funds are volatile, like sector funds, dollar cost averaging allows you to buy during a downturn.

What can we do About This?

Here are a couple takeaways from this study.

1. Don't Chase Best Performing Funds

Chasing best performing funds is a recipe for disaster. Once you find a fund that has been doing well and decide to switch, two things happen. First, you are buying in at a high. Most likely the news that has caused the fund to do well has already been priced in and future returns will revert back to the mean or even trail the market. Second, you are most likely exiting your old fund at a low (If not why else would you be switching?). Again, as long as the old fund is diversified, you are probably giving up a lot of upside when it eventually appreciates.

2. Use Asset Allocation ETFs

Throughout the study, asset allocation funds have had a small gap. This may be due to the fact that using one fund that encompasses many asset classes is simple for the investor and the investor does not have to perform tasks like rebalancing. On the flip side, more volatile funds like sector equity have the widest gap. Timing these funds is much harder likely leading to investors mistiming.

Conclusion

Investors in aggregate are failing to match the returns of the funds they invest in. Creating and sticking to a strategy while investing early and often are the best ways to ensure you are earning the best returns possible from your funds.